- The

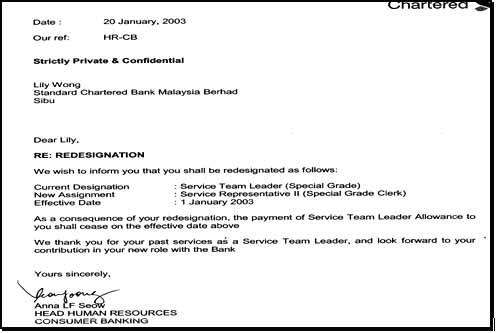

redesignation letter- “Thank you for pass service as a STL”- what does that

mean? - She has been demoted and lost her RM250 including bonus on it.

- The Bank issued her another appointment on 26 August

2006 (11 years later) with New conditions (para 4) introduced.

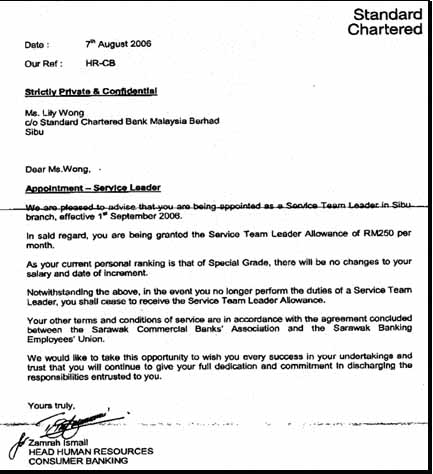

The second

appointment letter dated 26 August 2006 that show how the bank plays around

with the terms and conditions of its employees – even in the midst of the

dispute. A cloak and dagger operation.

- Can you appoint a staff to the same position twice- 11

years later- what a sick Joke!!!!

PARA 6

of the Bank’s letter

- In January 2003, STLs in West Malaysia raised a

similar dispute. On 19 Feb 2003 the Bank responded to these STLs there and

maintained the view that the bank has a right to stop the STL allowance.

-

In April 2003, we raised the issue involving Yii. The

bank vide letter 30 April 2003, and after having the opportunity of

earlier addressing the issue with the STLs in West Malaysia came to the

decision that the STLA for Yii shall be restored in full and arrears paid to

him. This is the said letter.

- So it was not an oversight by the previous HR. The

Bank made a conscious decisions after due consideration. The new HR now

claim that the previous HR made a mistake. So what guarantee that a future

HR will not later claim that the current HR also makes a mistake? This

offends the very core of integrity that is of utmost importance in the

Banking industry.

- To make matters worse, the Bank did not even informed

SBEU on when it unilaterally withdrew the reinstated STLA of Yii. It also

secretly continued to deny Lily her SLTA until she discovered it.

-

The Bank even want to claim the moral high ground by

saying that they did not ask Yii to return the STLA that the previous

reinstated to him.

-

So can you trust the bank anymore??

PARA 7 & 8 of the Bank’s letter

This is blatant lie.

- At the very outset SBEU made it clear that to resolve

the dispute the STL must be restored in full. We EVEN are prepared to allow

the STL to perform the new roles as decided by the bank, but the STLA must

remain as a personal to holder basis as provided by under Article 36 of the

CA.

-

This is SBEU‘s letter dated 27 January 2005 ( 1 year

and 7 month sago) to the bank:

- This position was reiterated to the Bank during the

conciliation meeting held at the Industrial Relations Department and another

meeting between SCBA/SBEU in the presence of other Banks HR Managers. Our

position was made clear to them

-

To claim that only now that SBEU wants arrears

is a blatant lie and an attempt to hoodwink SBEU members.

-

Lying is a highest from of misconduct. And is

unacceptable of any employee in the Bank. Can we trust the bank anymore?

-

For the record, during one of the meetings the Bank

also offered an exgratia of RM2000.00 to the employee to resolve the

matter. This is a cheap attempt to bribe members. SBEU members’ rights can

NEVER be bought!

PARA 9 OF Bank’s letter

- Yes $20,000- that is the amount the Bank cheated the

employees out off. And they made $700 million last year.

-

SBEU never agreed – see para above. SBEU has never

and will never compromise the rights of SBEU members that are enshrined

under the CA. ( See point no 11)

5 Day week

PARA 11 of Bank’s letter

- Yes SBEU urge Banks to introduced 5 days week- as long

as 15 years ago. We have no issue with 5 day week. The issue is that the

SCB directed employees to work 5 ˝ week for employees in Kuching-

This is not gazetted and this is against the CA.

-

In the spirit of good will SBEU is prepared to allow

banks that need to open certain branches on the 2 and 4 Saturdays provided

suitable arrangements are in place. Such as rotation for staff, different

branches open on alternative weekends, seeking volunteers and more

importantly the banks must have demonstrated a caring and fair treatment of

its employees.

-

At the outset these other banks took the initiative to

implement the above measures to minimized adverse impact on their employees.

And where overtime needs to be paid, the other banks re prepared in

principle to pay full overtime instead of meal allowance.

-

SCB refused and is the leading opponent the

uniformity in overtime rates between Sabah Sarawak and NUBE. Do you know

what SCB insisted initially?

-

In February 2003, SCB actually wanted to continue the

5 ˝ day week for Kuching- meaning that Employees in Kuching work from 9.00am

to 5.30pm on Mondays to Thursdays; from 9am to 5pm on Fridays and 9am to 1

pm on 2 and 4th Saturdays. Meaning it will not introduce a 5

days week for Kuching employees while 30 other branch in Sarawak and

Malaysia have the 5 day week. This is again consistent with the Banks

mantra of maximizing its exploitation of employees.

-

The reason that it wanted such arrangements is so that

they do not have to pay overtime. So it itself wanted to stick with the 5

1/.2 day week for Kuching employees (it was only after meeting with SCBA

that SCB reluctant agreed to pay overtime for those who has to work on 2 and

4th Saturdays).

-

To us the issue is clear, since the bank is not

willing to implement a full 5 days week for all employees, then we must

follow the CA. Please also note that unlike the CA with NUBE, in Sarawak

our CA does not allow the bank to implement 5 ˝ day week.

-

So who is being unreasonable? SBEU for believing that

all employees should work the same hours and all employees to be treated

equal- or the Bank who demand absolute say in managing its employees to

reduce cost and to violate an expressed provision of a Court Award?

-

The bank to this day continued to intentionally

violate the CA so that it can exploit employees to the maximum.

PARA 13 of Bank’s letter

- So is the Bank

reasonable